Content Delivery Network (CDN) providers are now more in demand than ever. The unmatched surge in popularity of streaming services, social networks and online gaming (in no small thanks to the global pandemic), has significantly increased the load on data centers. And CDN clients account for a significant part of this increase.

Content Delivery Network (CDN) providers are now more in demand than ever. The unmatched surge in popularity of streaming services, social networks and online gaming (in no small thanks to the global pandemic), has significantly increased the load on data centers. And CDN clients account for a significant part of this increase.

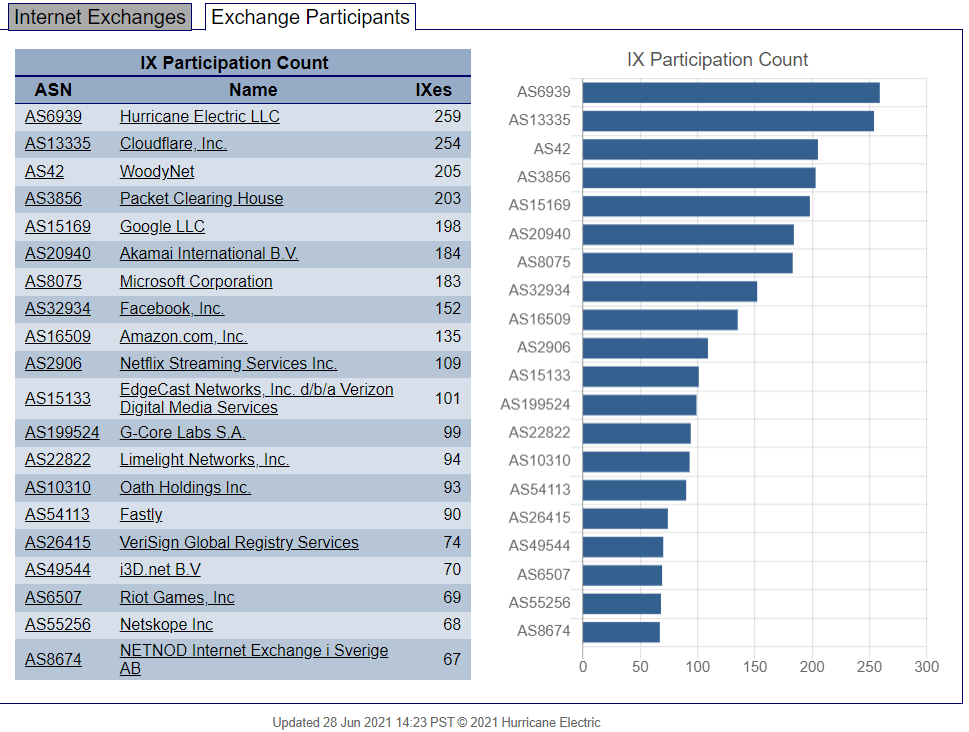

CDNs around the world are also one of the key participants of Internet Exchange platforms (IXP). The graph by Hurricane Electric below shows examples of some of the largest global CDN providers (list on the left) and the number of IX platforms they are connected to (data on the right).

We see that large global CDN providers such as Cloudflare, Akamai, Limelight, Fastly, G-Core, etc. rely heavily on peering, and this is understandable: if your goal is to deliver content to the end user as efficiently as possible, traffic exchange points allow you to connect to the Internet Service Providers (ISP) directly.

That said, the strategy of CDN providers today is slightly different from what it was five or ten years ago. Take CDNvideo, for example, one of leading CDN providers in Russia and CIS. Having been focused mainly on media and TV broadcasting before, after the pandemic the segment of streaming services and e-commerce has grown dramatically. The change called for the need to optimize their content delivery strategy, and prompted many CDNs around the world to start developing within the largest existing access networks. On the one hand, this strategy helps to get more access faster, but on the other hand – the infrastructure of such networks often renders any scalability impossible. This is also one of the reasons why CDNs rely so heavily on peering nowadays, compared to the past.

But growth, it seems, is inevitable, and CDN providers need a lot of power to ensure the availability of their resources as the density and load of their racks and servers only becomes higher. Older data centers are usually not very well suited for this, especially those with little space left in the data halls. Therefore, modern data centers such as IXcellerate are very attractive to CDNs, thanks in large part to the ability to scale their digital infrastructure in a secure and reliable environment.

In addition to the space for growth, CDNs require high levels of connectivity to help distribute their content. More telco nodes = more options for the CDN provider. For example, IXcellerate data centers have more than 50 telecom operators and several traffic exchange platforms, including Eurasia Peering, whose peak traffic has recently reached 300 Gbps and the number of connected peers over 170.

“As a provider of cloud and edge services, we need complete confidence in the availability and operational stability of the equipment, which can be guaranteed by the compliance of the data center with the Tier III standard. Another key selection criteria for us is the presence of all largest local telco carriers and IXPs” – says Dmitry Stepanov, executive director of business development at G-Core Labs.

John Souter, former CEO of LINX (London-based IXP) and a member of the IXcellerate Advisory Board, believes that if the data center strategy involves attracting CDN players, it is important to be adaptable:

“CDN providers’ approach to hosting their infrastructure is now much more complex than it used to be. IXcellerate does everything to make CDN providers feel comfortable with us not only now, but also within the next 5-10 years. To achieve this, we are focusing on providing lots of growth space in a carefully maintained environment, as well as stellar customer service, and also developing a level of connectivity that would be an attractive alternative to the largest national operators. Balancing these two tasks is not always easy, but we believe our chosen strategy will yield great results”.

While global media and tech giants like Netflix and Apple generally do not need dedicated CDN providers to deliver their services, even they often use third-party CDNs for flash events such as new OS releases.

Thus, regardless of the constantly evolving trends and strategies, CDNs (including those serving user-generated content like YouTube) will most likely always have need for local data centers like IXcellerate to store the data closer to the end user and be able to scale the infrastructure.

However, the one thing that still impedes seamless content delivery in every corner of the world – is the lack of decent data center infrastructure in the edge-regions, like Russia’s Far East, for example.

But that is another story for another article.